All Categories

Featured

Table of Contents

Play the waiting game up until the building has actually been seized by the area and sold and the tax sale.

Going after excess proceeds provides some pros and disadvantages as a service. Consider these before you add this approach to your realty investing collection. This strategy calls for minimal effort on the marketing side. If marketing is something you definitely despise, this may affect your choice. There can be some HUGE upside potential if and when the celebrities line up in your favorthey seriously need to in order to accomplish the most effective feasible end result - free tax lien property list.

There is the opportunity that you will make nothing in the long run. You may lose not just your cash (which ideally won't be significantly), however you'll also lose your time as well (which, in my mind, is worth a great deal extra). Waiting to collect on tax sale excess needs a great deal of sitting, waiting, and wishing for outcomes that generally have a 50/50 opportunity (typically) of panning out favorably.

Gathering excess proceeds isn't something you can do in all 50 states. If you have actually currently got a home that you desire to "chance" on with this method, you would certainly better wish it's not in the incorrect part of the nation. I'll be honestI haven't invested a great deal of time messing around in this location of investing due to the fact that I can not manage the mind-numbingly sluggish rate and the full absence of control over the process.

If this seems like a business opportunity you intend to study (or at the very least discover more regarding), I understand of one guy that has produced a full-on program around this particular type of system. His name is and he has actually explored this world in excellent information. I have been with a couple of his training courses in the past and have located his approaches to be extremely effective and legitimate money-making strategies that work very well.

Property Tax Foreclosed Homes

Tax liens and tax obligation acts often market for higher than the county's asking cost at public auctions. Furthermore, the majority of states have regulations influencing proposals that go beyond the opening quote. Repayments above the county's standard are known as tax sale excess and can be profitable financial investments. Nonetheless, the information on excess can produce problems if you aren't knowledgeable about them.

In this article we inform you how to obtain checklists of tax overages and make money on these properties. Tax obligation sale excess, likewise called excess funds or exceptional bids, are the amounts quote over the starting cost at a tax public auction. The term describes the dollars the financier spends when bidding process above the opening quote.

The $40,000 boost over the initial quote is the tax sale excess. Declaring tax obligation sale excess indicates getting the excess cash paid throughout a public auction.

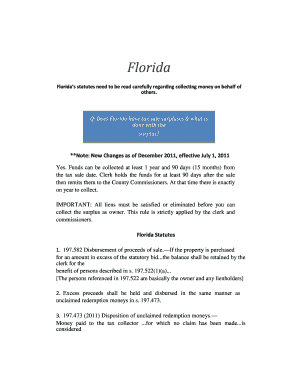

That claimed, tax obligation sale overage insurance claims have shared attributes throughout many states. surplus tax sale. Normally, the region holds the cash for a specific duration relying on the state. During this period, previous owners and mortgage holders can get in touch with the area and receive the overage. Areas usually don't track down past proprietors for this purpose.

If the period runs out before any type of interested events assert the tax obligation sale excess, the region or state typically absorbs the funds. Past proprietors are on a rigorous timeline to insurance claim excess on their properties.

Excess Proceeds From Foreclosure Sale

, you'll make passion on your whole bid. While this element does not indicate you can claim the overage, it does help alleviate your costs when you bid high.

Keep in mind, it could not be legal in your state, implying you're limited to collecting interest on the overage. As mentioned over, a capitalist can discover methods to make money from tax sale overages. Since passion income can relate to your entire proposal and past owners can claim excess, you can utilize your expertise and tools in these scenarios to make best use of returns.

A crucial aspect to bear in mind with tax sale overages is that in a lot of states, you just need to pay the county 20% of your overall proposal up front. Some states, such as Maryland, have regulations that surpass this regulation, so once more, research study your state regulations. That said, many states adhere to the 20% rule.

Rather, you just require 20% of the quote. If the residential or commercial property does not retrieve at the end of the redemption period, you'll need the continuing to be 80% to obtain the tax deed. Due to the fact that you pay 20% of your bid, you can make passion on an overage without paying the complete rate.

Once more, if it's legal in your state and county, you can function with them to help them recover overage funds for an additional cost. So, you can gather passion on an overage bid and bill a fee to streamline the overage case procedure for the previous owner. Tax obligation Sale Resources just recently released a tax obligation sale overages item particularly for people thinking about going after the overage collection business. free tax sale.

Overage collectors can filter by state, county, home type, minimum overage quantity, and optimum excess quantity. Once the information has been filtered the collection agencies can make a decision if they want to include the avoid mapped data bundle to their leads, and then pay for just the validated leads that were located.

Tax Foreclosure Lists

In addition, simply like any kind of other financial investment strategy, it offers special pros and cons.

Tax sale excess can create the basis of your investment version due to the fact that they give a low-cost way to make money (online tax deed auctions). You do not have to bid on buildings at public auction to spend in tax sale overages.

Instead, your research study, which may include avoid tracing, would certainly cost a fairly tiny fee.

Your sources and method will identify the very best atmosphere for tax overage investing. That stated, one technique to take is gathering interest above premiums. To that end, investors can purchase tax sale excess in Florida, Georgia - tax lien fund, and Texas to take advantage of the costs bid regulations in those states.

Any type of public auction or foreclosure involving excess funds is an investment chance. You can spend hours researching the previous owner of a residential or commercial property with excess funds and call them only to uncover that they aren't interested in seeking the cash.

Latest Posts

Buying Tax Foreclosed Properties

Government Tax Homes For Sale

Government Tax Properties For Sale